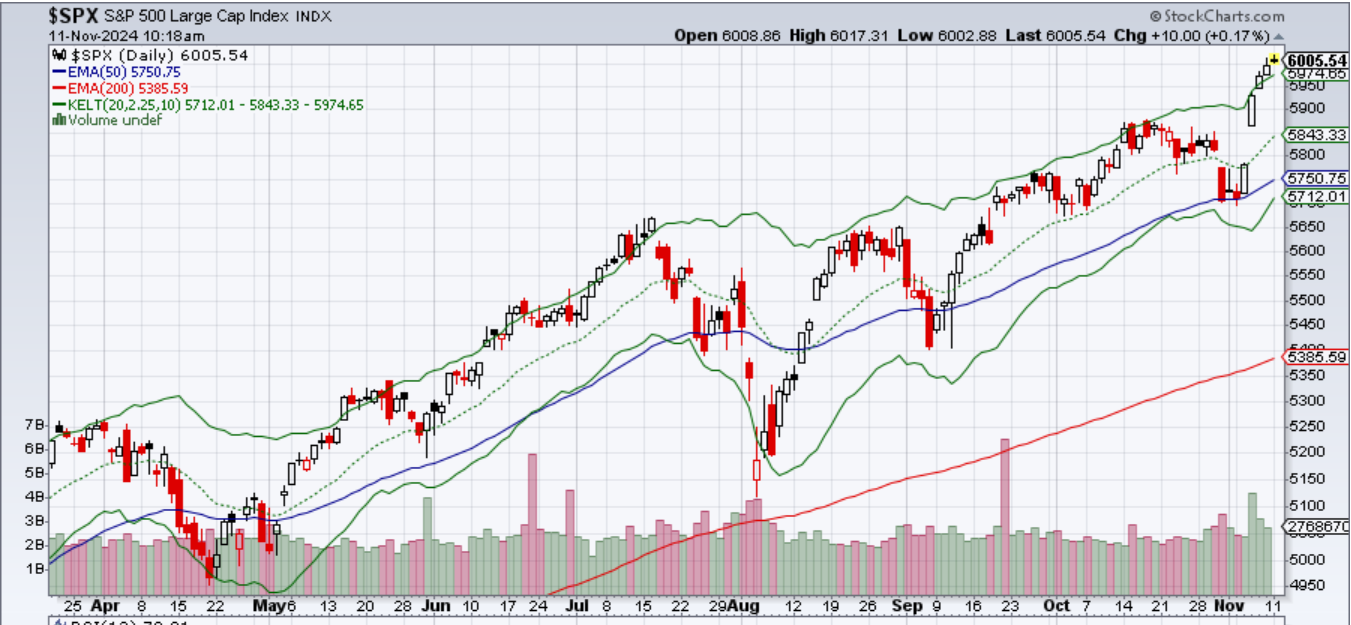

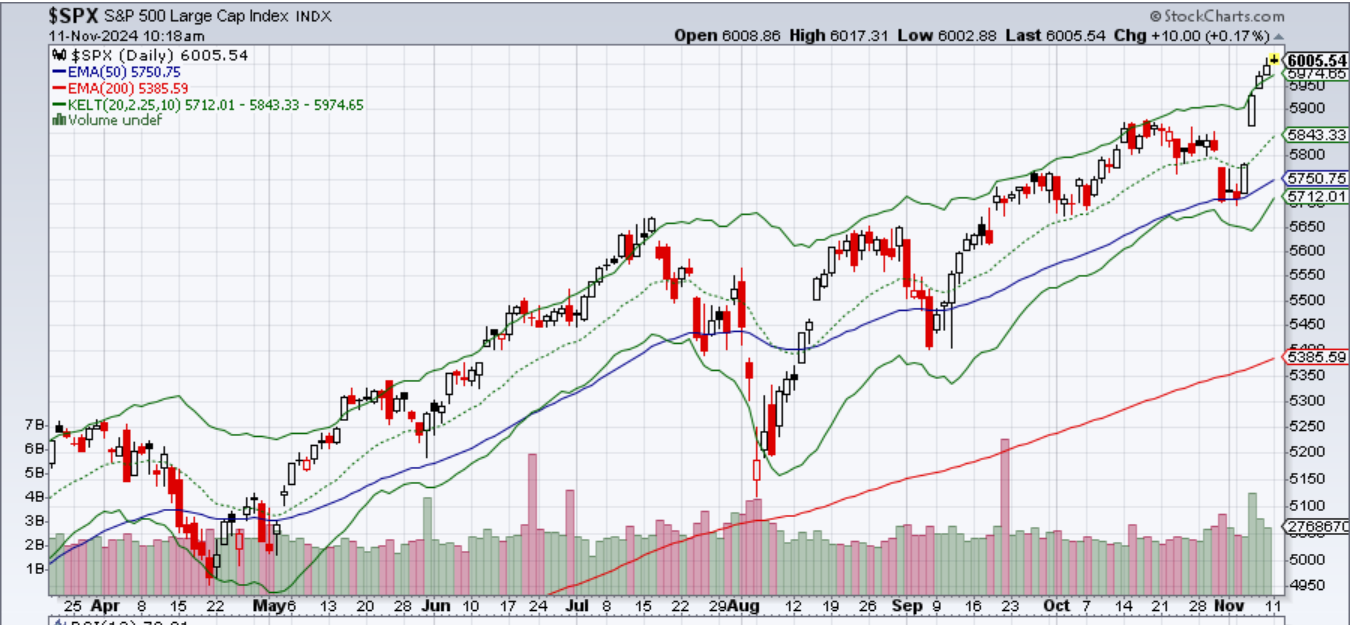

Now that the dust has settled on the election, we can more easily assess where we are in the markets and where they are going.

As I’ve made clear in other contexts, the actual winner of the election doesn’t matter that much. What matters is eliminating the uncertainty of the election so that market participants can take action more freely--action they were inclined to take before the election. Before and after the election, the investment landscape has been in a firmly risk-on mode. That will likely continue until at least the end of the year as lagging professional money managers attempt to catch up to the major stock market indices. The recession that many had expected never arrived.

In this election, one of the biggest foreseeable risks to market participants was not who would win the election, but the risk that the election might not be decided for several weeks or months. When that risk was eliminated, market participants were free to take on risk in many ways, and in some ways to cut risk. In that vein, it’s worth assessing who the winners and losers appear to be in this early post-election moment.

The winners are big business generally, as the major US stock market indices climbed to new highs immediately after the election, especially growth stocks. That’s also true for companies subject to higher levels of regulation like financials, including those that were potential targets of antitrust enforcement, such as big cap tech companies.

Certainly, cryptocurrencies are big winners with the prospect of a US strategic bitcoin reserve and increased liquidity in the financial system due to the Fed’s cutting the short rate. Further, the new President is a crypto supporter, and strong seasonal factors are in play for crypto currencies currently and for the next several months.

(Full disclosure: I have a position in GOOGL.)

On the other hand, bonds were sold, consistent with how they were selling off in the weeks before the election, as Trump‘s odds of victory were increasing. Losers really include just about all interest rate plays except for financials, such as gold, real estate, and high dividend paying stocks.

Why is this the case, especially with the Fed's cutting the federal funds rate? After all, stocks and assets that are more sensitive to interest rates tend to do better when the Fed cuts.

On the other hand, a major risk for bond investors is that the US will cut taxes under Trump and not decrease spending, creating a ballooning deficit consistent with what occurred in his first administration. That’s especially the case now that the Republican party controls both houses of Congress as well as the presidency. If deficits balloon, bond investors may require a higher interest rate from the US government to take on the increased costs of servicing the debt. That’s bad news for homebuyers and sellers as longer-term rates remain high.

Recessions have started under every Republican presidential administration since my birth in 1968. The trend of cutting taxes, while not decreasing spending, can often lead to a “sugar high” in the economy as asset prices inflate dramatically for time. That then can lead to inflation increases and rising interest rates, or rates that stay higher than they would be otherwise, leading to a recession due to the burdens of heavier borrowing costs.

It doesn't have to go this way, but it often has. If this pattern holds like it has before, our dual momentum approach provides a good answer. As prices swing high and then begin to break down, a dual momentum approach like ours will ride the trend up and then begin cutting risk as the trend breaks down. That's precisely what happened when we sold our gold positions last week.

If there is a recession in the next four years, long-term US treasuries should be a big winner as the fed will have to cut rates to stimulate the economy anew. Gold and other interest rate plays will probably perk up and do well again in that environment as the economy recovers.

For now, however, investors can enjoy the risk-on environment in certain assets and ride the wave up, while avoiding those that are selling off. In our models, we are long digital assets and growth stocks. In our fixed income models, we are increasingly hewing to the short end of the duration curve. This is a reversal of course from the summer when it appeared as though long-term interest rates would fall. At the same time, we hold positions in high-yielding bonds because those are correlated to stock prices, which remain strong.

It's important to note that we take actions like these because our dual momentum metrics and parameters dictate it, not because of our outlook on the macro economy. Under our dual momentum approach, we expect the price action in the markets to give us the most important information, and that is precisely what has led us to make these good investment decisions.